The US dollar (USD) is the world’s reserve currency and has served as a safe haven for investors from around the world. This status largely reflects the strength of the US economy and the relative stability of its goods, services, and financial markets. Yet the USD has lost roughly 8 percent of its value since the start of the Trump administration, and its response has been strangely enthusiastic.

President Trump has repeatedly expressed his support for “not a weak dollar but a weaker dollar,” adding that “you make a hell of a lot more money” with a weaker USD. But this is just another example of economic shortsightedness. Like the bad economics displayed across many of the administration’s other proposals, this policy ignores knock-on and secondary effects. Yes, in a vacuum, a weaker dollar could benefit some market participants, such as large US-based multinational corporations (MNCs) whose goods become cheaper for foreign purchasers. But this benefit ignores negative spillover effects.

Money held by consumers in the US will lose some of its value, especially when buying imported goods. This will exert more inflationary pressure, which could mean further monetary tightening. If consumers see their real wealth reduced from an erosion of the value of their dollars, their demand for goods, including domestic products, will drop—hurting the very MNCs that the ‘weak dollar’ policy is supposed to help.

Another aspect that is ignored by solely focusing on exporters is the jeopardy to the USD’s status as the world’s reserve currency. The USD and financial products denominated in dollars, such as Treasury securities or corporate bonds, are the safe asset of choice for investors from around the world. The benefit to the US is that private firms and the government alike can rely on such demand to fund their usual operations and projects. If foreign investors are concerned about losing money when exchanging their own currencies for the USD, their appetite for US financial products could fall, lowering US asset prices.

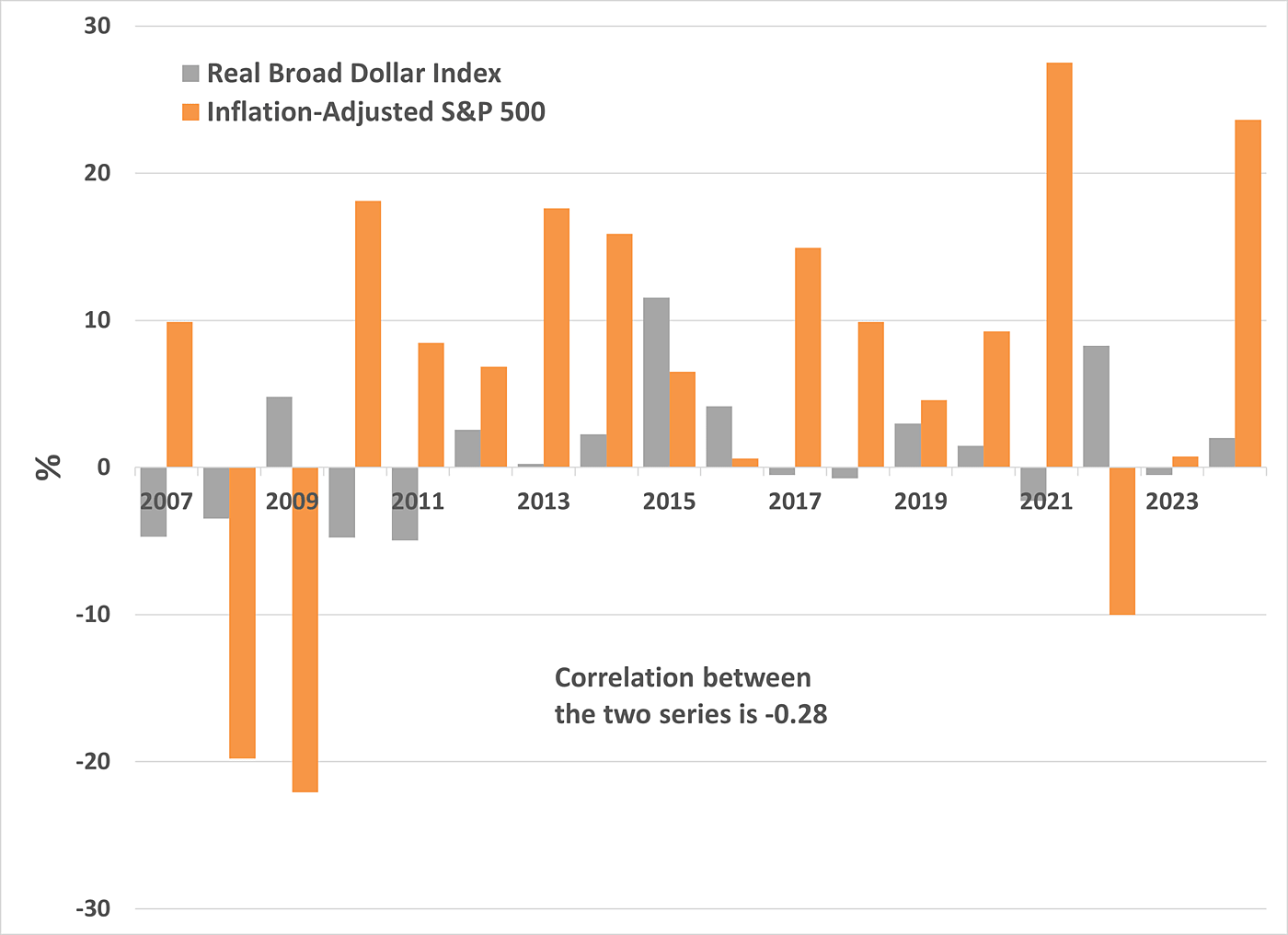

An analysis of the stock market’s performance in relation to the USD confirms that the transmission of a weak dollar to corporate profits is not straightforward. Figure 1 shows the annual percentage change in the dollar’s real value compared with the stock market’s inflation-adjusted performance over the same period for every year from 2007 to 2024. The value of the dollar is measured using the Real Broad Dollar Index collected by FRED. The S&P 500 is used as a proxy to measure the value of large-cap US corporations. As the graph shows, fluctuations in the dollar’s purchasing power are seldom correlated with large-cap corporate performance. Yes, on average, a weaker dollar implies elevated stock market performance (that is, the series are negatively correlated), but the strength of their correlation is only 28 percent.

Perhaps a host of factors could converge to have the positives of a weaker dollar outweigh the negatives, but the odds of that are unlikely. It is much more likely that any gains for exporters fall well short of the losses suffered by hurting US consumers and financial markets. Nor should there be any trust that the administration can fine-tune weakening the dollar by a “perfect” amount to boost MNC exports but not damage the real wealth of US consumers.

The administration’s international trade policies already risk jeopardizing the economic health of US consumers. It should not compound that risk with policy errors related to international finance. Expecting or encouraging a weaker dollar is not the way to make US goods more attractive any more than a dose of caffeine and sugar is a sustainable way of fueling a workday. Yes, it could work in the short run, but the long-run effects not only undo but also outweigh any quick gains.